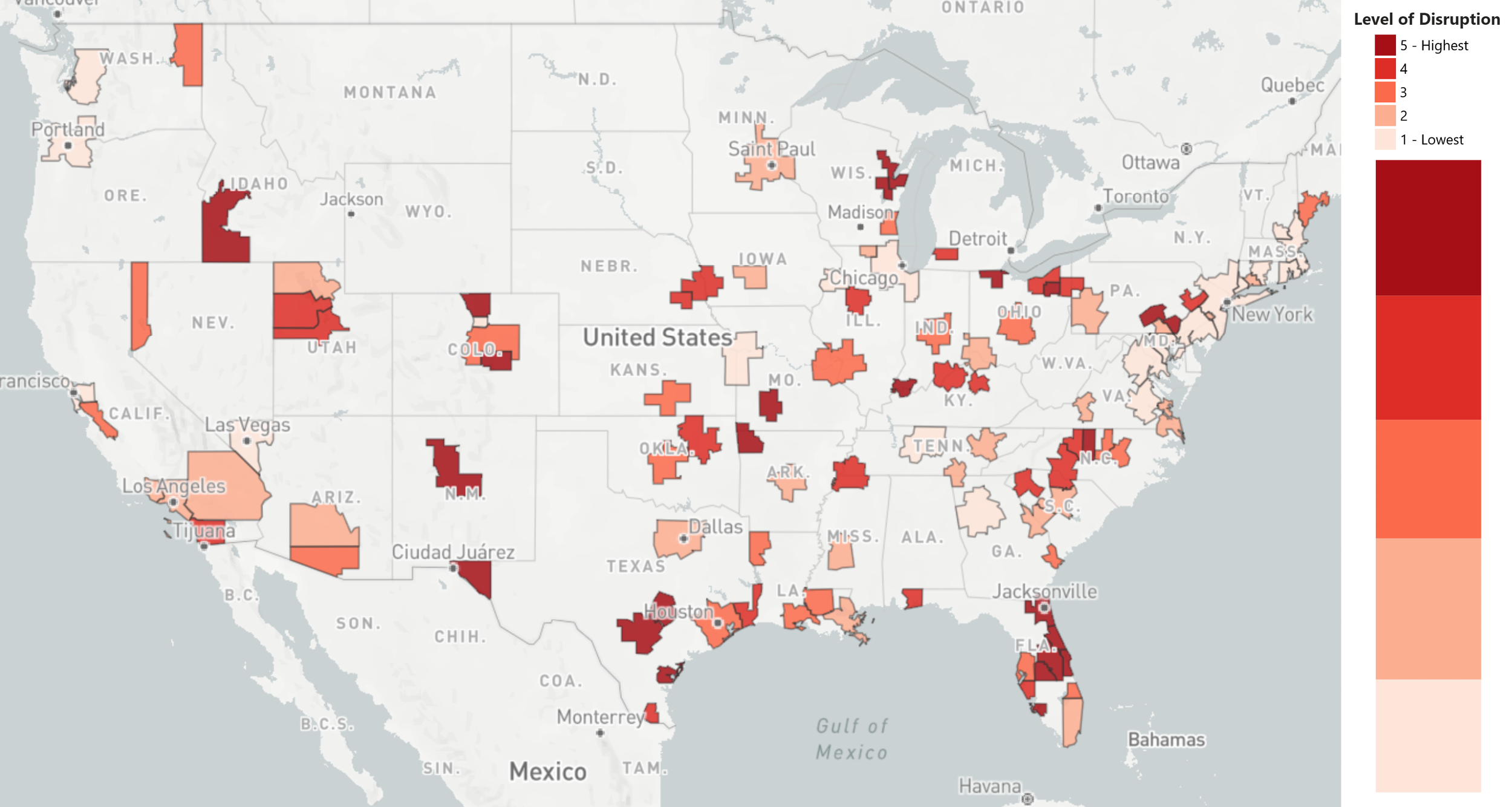

Washington, DC – Array Advisors and Array Analytics have developed a model to assess the likely level of disruption in the coming post COVID-19 climate across the top 111 healthcare markets in the US. Expressed in an interactive map, the study ranks the likely level of disruption in core-based statistical areas on a scale of one to five, lowest to highest.

To date, there has been a lot of conversation focused on very important but short-term issues, like restoring elective surgical volume. However, an even more critical conversation is required about the structural changes that will be unleashed from this tragedy. When people talk about a new normal, there is an implication that there will be a universal new normal. We believe the new normal will differ significantly across markets – and most will not return to the dynamics of the past.

Why? Because two fundamental pillars of local provider sustainability will be gone.

1. The level of commercially insured lives in many markets will never be as high again.

The pandemic is causing severe economic disruption, particularly in areas with high levels of employment in energy and tourism sectors. What we have seen in past disruptions is that once employment in specific sectors is displaced, the magnitude of that workforce rarely recovers, especially if technology replaces that labor. We also have an aging workforce, which has contributed in part to a major decline in workforce participation in the last two decades. The combination of severe employment shock and technology adoption will only accelerate that decline and lead to an increase in the percentage of the population that is uninsured and underinsured in each market. While we expect the impact of the pandemic will be mitigated in states that have expanded Medicaid and some lives will shift to Medicare, the number of premium commercial lives will not fully recover.

This imminent shift in payer mix will have profound implications for hospital finances and long-term cost structures. However, those systems and regions with good balance sheets and strong investments in future delivery platforms will be much better off than others in adjusting to the new normal compared to those whose journeys are beginning in a crisis.

2. The local physician monopoly or oligopoly is gone, and telemedicine is here to stay.

The COVID-19 crisis has demonstrated the public’s willingness to use telehealth services, and we expect that the new reimbursement rules that enabled systems to rapidly ramp up their capabilities will remain in place. Simply put, it will be hard to take something away after consumers have it. Coupled with the continuous release of new remote diagnostic tools that vastly increase the clinical value of virtual visits, we believe that the opportunity for telemedicine to disrupt markets has been significantly strengthened.

As a result, local hospitals and their aligned physician groups who have come to completely dominate some markets will be subject to true external competition. We would also argue that the more consolidated the market is, the higher the rates are to payers. Further, the more commercially insured lives there are, the more attractive the market will be to outside providers to disrupt. This will be especially true in markets without certificate of need laws, which could enable nationally branded groups to penetrate local markets through telehealth consultations and then build or acquire local procedural capacity as needed.

The coming shift in competitive dynamics is unprecedented in the experience of the modern healthcare industry. While urgent care and other more recent innovations have disrupted parts of the health care ecosystem in the recent past, their impact has ultimately been additive to the status quo, resulting in greater health care spending rather than replacing existing providers and business models. The new normal after COVID-19 will be a fundamentally restructured health care market.

Early signs of change are already here. Provider systems like HCA have seen their stocks go down over 30 percent from their 2020 market high-water mark, while One Medical valuation is up over 50 percent from the beginning of the COVID-19 crisis three months ago. The industry will not just react to the COVID-19 crisis in the short term. As it opens its eyes to the long-term shifts in power among participants in each market, those with the means will begin to take advantage of new opportunities.

METHODOLOGY

Market Definitions:

Markets are defined by core-based statistical areas (CBSAs). Our study includes 111 CBSAs. Each CBSAs was included in our study if: 1) it met our criteria for population size and number of hospitals, and 2) there was sufficient available data for us to assess it across our five key variables. Some data used to derive our variables was only available at the state level. In those cases, we applied state-level data to each CBSA based on the state it is located in. If a CBSA spreads across multiple states, we assigned the state of the largest city within the CBSA.

Key Variables:

- Payer Mix Deterioration (1 to 5 score, lowest to highest): This metric was calculated at a state level and then applied to each market. Our metric is a combination of 1) the 2019 percentage of the workforce employed in an industry vulnerable to disruption as a result of the pandemic¹, and 2) the status of Medicaid expansion in the state.

- Capital Position (1 to 5 score, strongest to weakest): This metric is derived from the credit ratings of key health systems within each CBSA, and we also accounted for median household income in the market.

- Market Concentration (1 to 5 score, lowest to highest): This metric is based on the 2016 Herfindahl-Hirschman Index of each CBSA.²

- Telehealth Willingness (1 to 5 score, lowest to highest): This metric was calculated at a state level and then applied to each market. Our metric was derived from the observed adoption of telehealth in late April³, which we then adjusted to control for the incidence of COVID-19.

- Bed Supply Excess (1 to 5 score, least to most): This metric was calculated based on the available hospital beds and total hospital beds in each market according to recent surveys conducted by the American Hospital Association and data compiled by the American Hospital Directory.⁴ We also accounted for potential unemployment, as in “Payer Mix Deterioration,” assuming that it could lead to lower community health status and generate some additional utilization.

- CON Program (Yes or No): This binary metric is the presence or lack of certificate of need laws that regulate acute care hospitals at the state level.

Overall Rating:

To assign an overall rating for each market, we generated a blended score of the five factors, each weighted according to our assessment of their relative impact. The markets were then ranked by the blended score and divided into 5 groups, with 1 being the lowest and 5 being the highest level of disruption.

Sources:

- Muro, M. et al., “The places a COVID-19 recession will likely hit hardest,” The Avenue, Metropolitan Policy Program at Brookings, March 17th, 2020, https://www.brookings.edu/blog/the-avenue/2020/03/17/the-places-a-covid-19-recession-will-likely-hit-hardest/.

- Johnson, B. et al., “Healthy Marketplace Index,” The Health Care Cost Institute, September 2019, https://healthcostinstitute.org/research/hmi-interactive#HMI-Concentration-Index

- The Chartis Group and Kythera Labs, “Telehealth Adoption Tracker,” May 2020, https://reports.chartis.com/telehealth_trends_and_implications/.

- Jha, A. et al., “HRR Scorecard,” Harvard Global Health Institute, March 2020, https://docs.google.com/spreadsheets/d/1xAyBFTrlxSsTKQS7IDyr_Ah4JLBYj6_HX6ijKdm4fAY/edit#gid=0.

The healthcare industry needs innovative solutions to battle the unprecedented coronavirus pandemic. Array Advisors, Array Analytics, and Array Architects will continue to provide ideas, design, and data-informed tools to help support their clients on the front lines of caring for our nation. For more tools from Array, visit our COVID-19 Resource Hub.

About Array

Recognized as a leader in healthcare facility design, consulting and technology, Array offers knowledge-based, data-informed services, including planning, architecture, interior design, transformation and asset advisory services. Using Lean as a foundation for a unique process-led approach, Array’s deliverables use data and technology to leverage real-time patient and real estate market trends required by today’s healthcare organizations. The company’s devotion to a healthcare-exclusive, integrated practice springs from the belief in the power of design and technology to improve patient outcomes, maximize operational efficiencies, and increase staff satisfaction. Learn more.

Media Contact

Craig Meaney

Communications Manager

610-755-6488

@ArrayArch

cmeaney@array-architects.com